Prepaid expenses are prevalent because there are numerous instances where payment is required before goods or services are delivered. Example of Prepaid Expenses AccountingĪ company pays $60,000 in advance for directors and officers liability insurance for the upcoming year.Any charges that a corporation expects to incur in the future are prepaid expenses. Both of these actions should be governed by a formal accounting policy that states the threshold at which prepaid expenses are to be charged to expense. To extend this concept further, consider charging remaining balances to expense once they have been amortized down to a certain minimum level. Instead, charge these smaller amounts to expense as incurred. If not, reconcile the two and adjust as necessary.Ī best practice is to not record smaller expenditures into the prepaid expenses account, since it takes too much effort to track them over time. Once all amortizations have been completed, verify that the total in the spreadsheet matches the total balance in the prepaid expenses account. This entry should include the straight-line amount of amortization that will be charged in each of the applicable periods.Īt the end of the accounting period, create an adjusting entry that amortizes the predetermined amount to the most relevant expense account.

Record the amount of the expenditure in the prepaid expenses reconciliation spreadsheet.Īt the end of the accounting period, establish the number of periods over which the item will be amortized, and enter this information in the reconciliation spreadsheet. If not, charge the invoiced amount to expense in the current period. If the item meets the company's criteria, charge it to the prepaid expenses account. Upon the initial recordation of a supplier invoice in the accounting system, verify that the item meets the company's criteria for a prepaid expense (asset). The basic accounting for a prepaid expense follows these steps:

If a prepaid expense were likely to not be consumed within the next year, it would instead be classified on the balance sheet as a long-term asset (a rarity). The reason for the current asset designation is that most prepaid assets are consumed within a few months of their initial recordation. Another item commonly found in the prepaid expenses account is prepaid rent.Ī prepaid expense is carried on the balance sheet of an organization as a current asset until it is consumed. Examples of Prepaid ExpensesĪn example of a prepaid expense is insurance, which is frequently paid in advance for multiple future periods an entity initially records this expenditure as a prepaid expense (an asset), and then charges it to expense over the usage period. The prepaids concept is not used under the cash basis of accounting, which is commonly used by smaller organizations. If a business were to not use the prepaids concept, their assets would be somewhat understated in the short term, as would their profits.

#Prepaid expenses series#

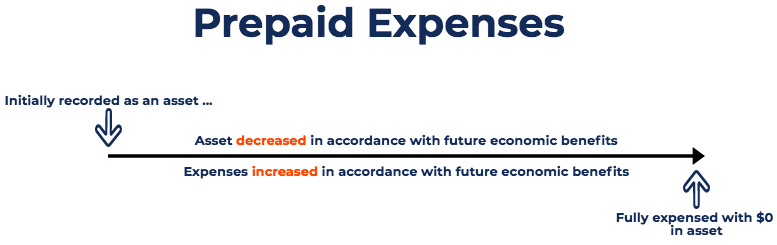

If consumed over multiple periods, there may be a series of corresponding charges to expense.Įxpenditures are recorded as prepaid expenses in order to more closely match their recognition as expenses with the periods in which they are actually consumed.

When the asset is eventually consumed, it is charged to expense. A prepaid expense is an expenditure paid for in one accounting period, but for which the underlying asset will not be consumed until a future period.

0 kommentar(er)

0 kommentar(er)